© 2026

Business Mechanics

Welcome to this seventh module, focusing on all of the ‘back office’ tactical skills and knowledge you will need to set up and run your new business effectively

Tackle the module in bite size chunks, don’t feel the need to do everything in one go and allow plenty of time to digest and apply the information covered

The module includes helpful ‘Activities’ for you to complete, it is strongly recommended that you undertake them to get the most out of the content and the key learning points

Allow yourself time to reflect and take on board the advice, key messages and suggested tasks in the programme to enable you to move forward with your self-employed campaign

This module will enable you to

-

Choose the most appropriate legal structure for you and how to make it happen

-

Confidently manage your accounting needs to ensure you are in control of your finances

-

Forecast and monitor income and expenditure and also cashflow to keep you on track

-

Identify and professionally implement your operational, infrastructure and IT needs

-

Understand and skillfully manage the legal and psychological contracts of employees

-

Deal with any regulatory, tax and other legal requirements efficiently and accurately

There are a range of formation options available to you, none are right or wrong, it is simply what is most appropriate in relation to your business strategy

We will look at a few of the most common formation routes shortly, you may also find the following websites useful in relation to the technical details of company formation

www.gov.uk/business-support-helpline

The three most common formation options are

Sole trader

-

Essentially, you are the business, there is no separate legal entity, you are it!

-

Quick, simple and inexpensive to both start up and manage in the future

-

As the owner you are personally responsible for all business debts and liabilities

-

Very little, if any, access to outside capital unless personal assets are used as security

-

The longevity of the business is likely to be limited to the longevity of you!

-

More difficult, but not impossible, to realise or sell the value of a self-employed business

Limited company

-

The business is a separate legal and tax entity to you, it exists with or without you

-

Company can be legally formed and administered and maintained at very low cost

-

Limited liability for the business debts and liabilities for you and any other owner(s)

-

Some (albeit diminishing) tax benefits e.g. re dividends, pension contributions etc

-

Easier access to outside capital or equity investment plus other funding sources

-

Provides timing and other flexibility around when and how profits are distributed

Partnership

-

Some (albeit diminishing) tax and flexibility advantages when distributing profits

-

Capable of raising funds via cash debt but only via the partners

-

Some limited potential for value creation and realisation of business value

-

Limited partnership = the partners have limited liability for business debts

-

A limited partnership can be more expensive to create than a general partnership

-

General partnership = the partners are liable for business debts

Franchising

Via any of the above three options, franchising can be a potential business growth route

-

Effectively, you are selling your business model to others to run their own business

-

Fast growth and positive cash generation can be simultaneously achieved

-

You provide the concept, the brand, the infrastructure and usually the supply chain

-

The franchisees pays you to have the opportunity to run a business and make a profit

-

Franchises can be sold by territory, by location, by product, by time and in other ways

-

Particularly popular in the fast food industry e.g. KFC, Subway, Starbucks etc

There are lots of excellent low cost PC/Mac/App accounting software packages available

If you do not want or need them, then a simple paper based system may suit you better

Either way, it is imperative that you ‘keep the books’ in an orderly and up to date state

Specifically, your accounts system needs to quickly, easily and efficiently

-

Enable you to generate income related documents e.g. sales invoices and receipts

-

Manage the administration of any purchases you make for the business

-

Record all of your income and expenditure items sufficient to be able to

-

Prepare a profit and loss account – usually monthly, quarterly and annually

-

Produce a balance sheet if it is needed – probably at least an annual one

-

Complete your annual tax return and any other tax info – needed annually

-

Complete quarterly VAT returns – if you are going to be VAT registered

If keeping the books proves to be too time consuming or distracting, then you could outsource it to a suitably qualified and experienced bookkeeper, perhaps initially on a self employed basis

Also, it is highly recommended that you engage the services of an accountant experienced in supporting businesses similar to yours to provide you with professional advice and guidance

A good accountant will identify savings and efficiencies for you that are worth more than the fees that they charge - so you are effectively getting them free of charge!

With the increasing prevalence of online and other fraud, security measures are needed, particularly around cash handling, payment authorisation methods/levels, business card access etc

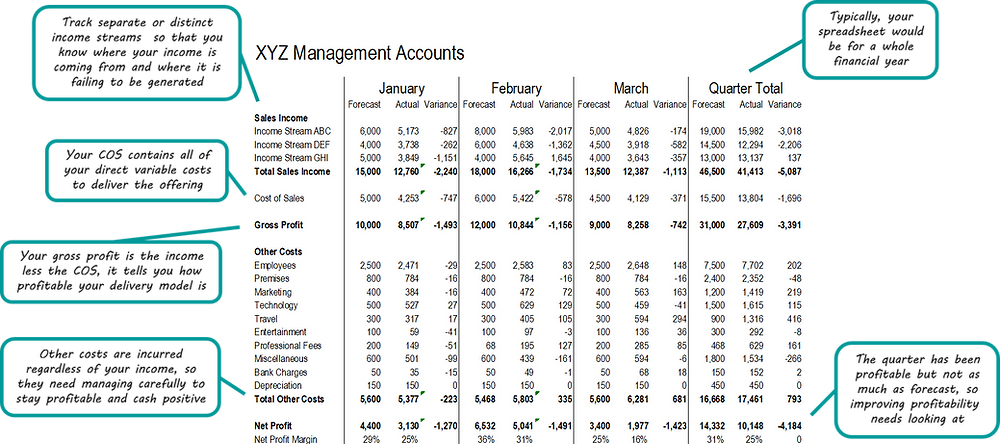

As we have seen, accounts are about accurately recording what you have already done financially and ensuring you are doing what must be done legally, financially and tax wise

Forecasting, in contrast, is about predicting as accurately as you can what you want and believe can be achieved financially

Forecasts can also sometimes be called budgets or projections – whatever the name, it is all about the same issue – looking forward

Effective management accounts are the combination of the two – tracking outcomes against forecast and making business decisions accordingly

The format for your management accounts will depend on

-

The nature of your business

-

What you need to track financially

-

How often you need financial info

There are lots of ways of structuring your management accounts, below is just one example for us to look at and identify some learning points, but not the only way

It shows a quarterly format, but could easily be extended to a six monthly or annual format, depending on your business needs

It has been designed using Microsoft Excel, but any spreadsheet software will do the job or you could elect to use specialist software

Whether you are making a profit or making a loss one thing is for sure, if you run out of cash then your business will cease trading and fail, hence the age old phrase ‘cash is king’!

So it is vital that you keep careful track of both what your cash in hand is now and where it is likely to be heading in the future

There are numerous ways of tracking your cashflow, it just depends on how much detail you need and how far forward you need to forecast to manage risk

The following is a simple but effective format you might find useful as a starting point to enable you to design a cashflow that is tailored to your business’s needs

As with the management accounts we previously looked at, it has been designed using Microsoft Excel, but any spreadsheet software will do the job or you could elect to use different or more specialised software

If you have (or somebody you know has) the IT skills to do so, you can get the manage accounts and cashflow spreadsheets to talk to each other

Needless to say, if you can start and grow your business using your own money then this will always be the lowest risk, lowest cost and lowest pressure route forward

Having said that, if using only your money is inhibiting business growth or stopping you from exploiting attractive opportunities to grow faster, then external funding may be a good idea

Funding to invest in your business can come broadly from two main types being

-

Debt – borrowing it, the main down sides being that there will usually be interest charges and repayment terms to meet with penalties for failing to do so

-

Equity – injecting money into the business in return for owning a share of it, the main down sides being reduced control of the business and dilution of dividend returns

The most common routes to raise funds are

-

Family, friends and personal network

-

Banks and other main stream lenders

-

Crowd funding and business angels

-

Venture capital and investment companies

Each funding type and route has advantages and disadvantages that need careful consideration

Rather than a one off event, think of raising funds strategically as a staged process over time at key trigger point moments for the business

Getting funding can get quite complicated, detailed and confusing, so be (and stay) clear in your mind about what you want and what you are trying to achieve

The operation of your business will fall into two general areas

-

Front-office operations – what needs to be done directly to sell and deliver your offering and delight the customer, usually consisting of key areas such as

-

Sales time, materials and online activity

-

Delivery time, materials and online activity

-

Back-office operations – to get to the point of making a sale and delivering it, the support the business needs to exist and function effectively, commonly including

-

Technology – PCs, laptops, software, website/internet, web design, hard/mobile telephony

-

Administration – marketing/admin activity, accounting software/systems, internal/external support

-

Premises – home usage, fixed/flexible office/commercial/storage space, utilities/services

-

Production – processes/materials/time to prepare marketing/sales/delivery products and services

-

Employees – this is a highly significant area that we can usefully spend some time looking at

Sooner of later, your growing business will eventually involve employing people

Below, we will look at the HR basics you need to consider, do and deal with

For more detailed up to date information, some of the best online info sites include

www.gov.uk/browse/employing-people

www.employment-advice-bureau.org

Useful as these sites above are and however helpful the info below is for you as a new employer, always remember the single most important piece of advice about employing people that you will ever receive, especially if you are dealing with a difficult or risky HR situation, namely – ‘if in doubt, pay for professional advice!’

There are four broad employment stages

-

Recruiting employees

-

Managing employees

-

Developing employees

-

Exiting employees

Before we have a look at each of them in more detail, it is important to emphasise the paramount importance, during all four stages of employing people, that you always remain legally compliant at all times, especially in relation to

-

Equal opportunities and equal pay

-

Disability and age discrimination

-

Health and safety and safe working

-

Working hours and minimum wage

-

Maternity and paternity arrangements

Failure to do so could result in very costly compensation claims in terms of money, time, energy and distracting you from making money

Recruiting employees

All of the recruitment related principles we looked at in module 3 (Selling Yourself) apply equally here, the difference being that, now, you are sitting on the other side of the table as the recruiter not the candidate

You might well find it useful to refresh your memory on all of the recruitment and interview principles we covered in module 3, but this time with your ‘recruiter hat’ on

The key additional points to highlight here being

-

Make the recruitment process relevant, transparent and effective by ensuring that

-

Job descriptions and/or person specifications are clear, reasonable and legal

-

Job adverts attract respondents with the skills and behaviours you are seeking

-

Adverts are placed where target candidates are likely to be looking for work

-

If appropriate, trawl LinkedIn and other online sites to proactively source candidates

-

The job application form design (if used) is compliant, robust and user friendly

-

CVs (if accepted and used) are assessed impartially, fairly and perceptively

-

Shortlisting of candidates is undertaken without any bias or subjectivity

-

Interview questions (or other assessment tools) are consistently used and scored

-

The interview or testing venue is well appropriate, well organised and structured

-

References and other checks are completed, accurately and in a timely manner

-

Recruitment decisions are arrived at objectively based on evidence and experience

-

Treat rejected candidates respectfully – they may reapply or become customers

-

None of these stages leave you open to accusations of discrimination or prejudice

-

Have a clear and defendable audit trail of the above points in case you are challenged

-

There must be a contract of employment for anybody recruited, so make sure it is

-

Thorough and covers all of the key areas you want included or are legally required

-

At the same time, uses plain English and grammar to make it easy to understand

-

Occasionally reviewed to stay in line with changing circumstance and legislation

Managing employees

In terms of values, words and behaviours, employees will take their lead from you, the owner, make sure that your words and your actions match up

Consistently and demonstrably exhibit the culture and performance you want to see in others

Respect has to be earnt not demanded, so ‘treat others the way you want to be treated yourself’

Remember and apply the age old but still relevant axiom - ‘you get what you reward’, specifically

-

Directly linking pay and benefits to personal performance and business outcomes can be very effective in focusing minds and activity

-

You need to establish the behaviours you want to reward and the ones that you want to deter and structure how you manage people accordingly

-

Then you need to make sure that the proposed rewards system makes what you want to happen come to pass

-

Your reward structure and pay scale also needs to work for now and as the business grows and needs change

-

Non-financial rewards can also be highly effective and valued by employees e.g. praise, recognition, employee benefits, etc

-

One of the best ways of finding out what might work is to undertake staff attitude surveys or just ask your employees

Make sure you set up

-

An easily maintained hard or soft copy system to record and track key employee info

-

A meaningful and welcoming induction programme to ‘settle in’ new employees

-

Robust HR policies on any essential or relevant HR areas for your type of business

Developing employees

The best managers naturally gravitate towards coaching staff wherever possible and appropriate

A simple but very effective three stage coaching process with an employee is to

-

Explain what you are going to coach them on – so they know what and why they need to learn

-

Show them what you are talking about – so they remember what you have explained to them

-

Involve them in making it happen – so the learning can be embedded, repeated and passed on

Effective coaching will involve

-

Creating a non-defensive environment

-

Setting clear goals and deadlines

-

Supporting, encouraging and inspiring

-

Positively recognising success

-

Openly identifying shortfalls

-

Engendering individual responsibility

Building effective and cohesive teams will also be critical as the business grows

With growth, the chances of having difficult or demotivated employees will also grow

A strong performance appraisal process will enable you to manage both high and low performance so there are 'no surprises’ – as everybody knows where they stand

Exiting employees

There are broadly two reasons or circumstances for exiting staff

-

Individual reasons e.g. poor performance or inappropriate behaviour, with the key points when dismissing an employee for poor performance or misconduct being

-

Have a sound and robust dismissal process in place and, importantly, follow it

-

Allow an individual the opportunity to defend themselves and to appeal

-

Have an audit trail of what you have done in case you are challenged

-

If uncertain, seek professional advice to avoid a dismissal claim or challenge

-

Business reasons e.g. market changes or financial performance, in which case, when making roles redundant remember

-

It is the role(s) you’re making redundant not the individual(s) in the role(s)

-

Individuals leaving redundant roles may be due redundancy or other compensation

-

There are required processes and procedures that you must make sure you follow

-

If in doubt, to avoid potential problems and costs, seek professional advice

-

You will put yourself in serious legal jeopardy and are likely to have serious difficulties and costs if you exit an employee due to them being pregnant or disabled

-

Quite apart from the rightness of exiting employees in a fair and reasonable way consistent with your culture, doing so will also, in the long run, save you money, time and energy

The regulatory matters you will have to deal with will depend on the nature of your new business, the following are probably the most common issues you will encounter

-

Companies House – with company formation comes responsibility to submit accounts and other key info, see www.gov.uk/government/organisations/companies-house

-

General Data Protection Register (GDPR) – compliance is compulsory if you are holding data on identifiable living individuals, see www.ico.org.uk

-

Minimum Wage – anybody you employ must earn at least the applicable minimum wage see www.acas.org.uk/national-minimum-wage-entitlement

-

Right to Work – it’s your responsibility to ensure recruits are eligible to do work, see www.gov.uk/government/publications/right-to-work-checks-employers-guide

-

Disclosure and Barring Service (DBS) – mandatory checks if engaged with the young or vulnerable, see www.gov.uk/government/organisations/disclosure-and-barring-service

-

Sector Specific Regulators – check if there are any regulatory requirements specifically for your type of business

In line with previous advice, it is highly recommended that you engage a suitably experienced and qualified accountant to keep you on the HMRC ‘straight and narrow’

The key tax areas for your to consider and manage may include

-

Income tax on profits – payable on any taxable income you receive as an individual

-

Self employed NI contributions – payable if self employed based on your taxable profit or income

-

Corporation tax – payable on profits generated via any trading company you've formed

-

Payroll taxes for employees – payable in relation to the staff remuneration package(s)

-

VAT due – payable or refundable if you are VAT registered via quarterly returns

-

Capital gains tax – payable on capital gains that are not exempt above specified levels

-

Inheritance tax – payable via an assessment on death on the assets held at that time

Just to repeat - taxation is a key area where the engagement of the professional advice of an accountant well versed in supporting small businesses is likely to prove highly beneficial

This module has enabled you to

-

Understand the options and appropriateness of different ways of legally constituting or forming your business

-

Design and and use key accounting, forecasting and cashflow skills, tools and techniques to effectively manage financial risk

-

Consider and begin implementing your key front-office and back-office operational issues and needs

-

Gain an overview and begin implementing any recruitment, management, development and exit plans for any employees you may have in the business

-

Deal professionally and efficiently with any regulatory or taxation issues you may encounter in a timely and professional manner

If you have found the content of this Self Employment programme helpful, please consider CLICKING HERE to make an online charitable donation, mentioning www.vitaeopus.co.uk

Go to the final module containing additional information and links by CLICKING HERE

Go to the Self-Employment main menu by CLICKING HERE